Easy Accessibility to Medicare Conveniences: Medicare Advantage Plans Near Me

How to Choose the Right Medicare Advantage Plan for Your Needs

Navigating the complex landscape of Medicare Advantage strategies can be a challenging job for many individuals looking for to make the best option for their healthcare needs. Understanding exactly how to analyze your particular medical care requirements, decode the different strategy alternatives, and comparing insurance coverage and costs can be frustrating.

Assessing Your Health Care Demands

When thinking about a Medicare Benefit plan, it is crucial to initial evaluate your specific health care requires thoroughly. Recognizing your current wellness status, prepared for medical costs, preferred doctor, and prescription drug demands are essential aspects in choosing the ideal strategy. Begin by reviewing your normal medical care usage over the previous year. Consider any kind of chronic problems that require routine medical interest or professionals. If you anticipate requiring specific treatments or surgeries in the coming year, make sure that the strategy you choose covers those solutions.

Understanding Strategy Options

Comparing Insurance Coverage and Expenses

In assessing Medicare Benefit prepares, it is important to contrast the protection and costs supplied by various plan alternatives to make an informed choice customized to your health care demands and monetary factors to consider (Medicare advantage plans near me). When comparing protection, consider the services consisted of in each strategy, such as health center remains, doctor brows through, prescription medications, and fringe benefits like vision or oral care. Examine whether the plans cover the certain medications you call for and if your preferred physicians and doctor are in-network

Similarly crucial see this is examining the prices linked with each plan. Recognizing these prices can aid you approximate your possible health care costs under each plan.

Eventually, picking the appropriate Medicare Benefit strategy entails striking a balance in between thorough insurance coverage and workable expenses. By carefully contrasting coverage and expenses, you can pick a strategy that finest meets your healthcare requires while straightening with your budgetary constraints.

Evaluating Supplier Networks

To make a notified choice when picking a Medicare Advantage plan, it is essential to examine the copyright networks available under each plan. Service provider networks refer to the physicians, health centers, and other health care companies that have actually contracted with the Medicare Advantage plan to offer services to its participants. Bear in mind that out-of-network solutions may not be covered or may come with higher out-of-pocket costs, so choosing a plan with a network that meets your requirements is crucial for maximizing the benefits of your Medicare Benefit coverage.

Reviewing Fringe Benefits

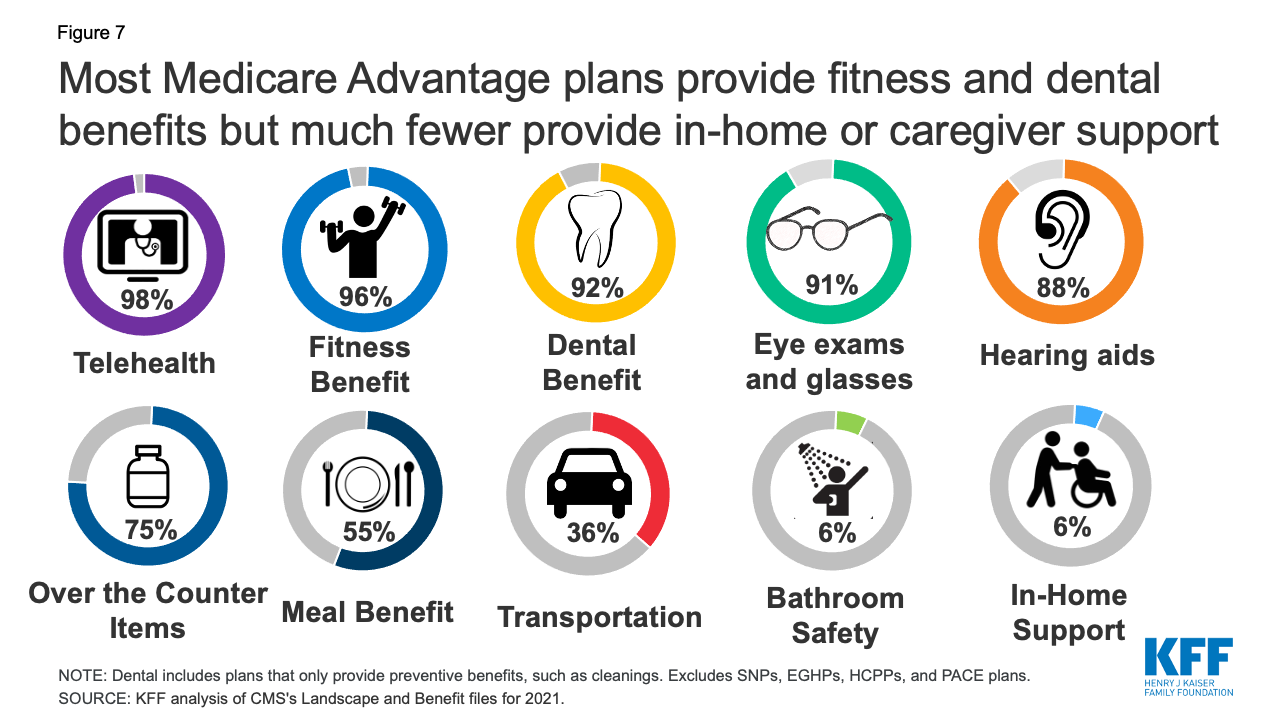

When evaluating Medicare Advantage plans, it is important to very carefully assess the additional resources supplementary advantages supplied past standard clinical protection. Medicare advantage plans near me. These additional benefits can differ extensively amongst various strategies and can include services such as vision, oral, hearing, health and fitness programs, transport to clinical consultations, and also insurance coverage for over-the-counter drugs

Prior to picking a strategy, consider your specific health care needs to determine which additional advantages would be most useful to you. As an example, if you put on glasses or need dental job regularly, a strategy that consists of vision and dental coverage would be helpful. Similarly, if you need assistance reaching clinical appointments, a strategy that supplies transport solutions might be helpful.

Evaluating the additional discover this advantages provided by Medicare Benefit plans can aid you choose a plan that not just covers your basic medical requirements yet additionally offers added solutions that straighten with your health care needs. By carefully examining these supplementary benefits, you can choose a strategy that provides detailed insurance coverage customized to your specific requirements.

Final Thought

In verdict, selecting the suitable Medicare Advantage strategy calls for mindful factor to consider of one's healthcare requirements, plan choices, protection, prices, provider networks, and fringe benefits. By evaluating these aspects completely, people can make an enlightened choice that straightens with their details demands and choices. It is necessary to carry out complete study and contrast various strategies to make certain the picked strategy will appropriately fulfill one's medical care demands.